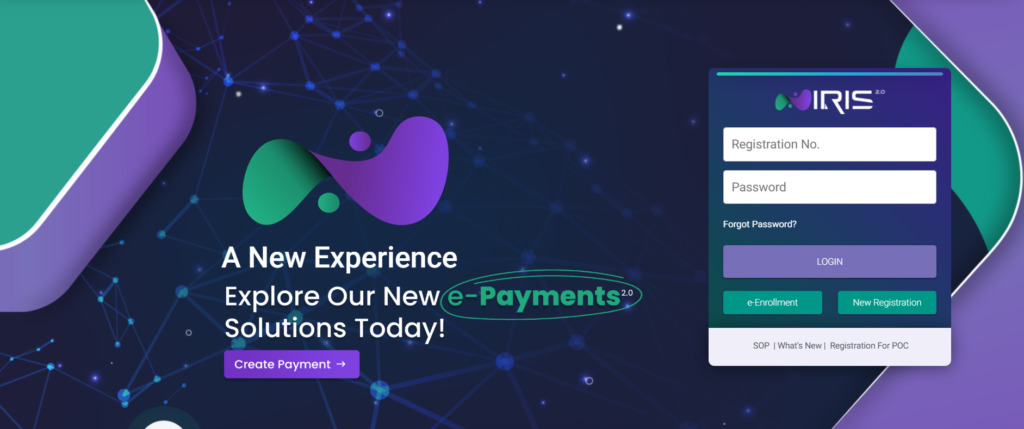

Get FBR Login – Enter Your Registration Number, Enter Password, File Your Income Tax Return – Recovered Your Password

FBR Login: A Comprehensive Guide

The Federal Board of Revenue (FBR) in Pakistan is the principal authority for tax collection and enforcement of tax laws. Over the years, FBR has introduced several technological advancements to make tax compliance easier for individuals and businesses. The IRIS portal, the primary online system for taxpayers, plays a crucial role in enabling users to file returns, pay taxes, and manage other tax-related tasks online. This guide provides a detailed overview of the FBR login process, its features, and its importance in ensuring smooth interactions with Pakistan’s tax system.

Understanding FBR Login

FBR login refers to accessing the IRIS portal, which serves as an online platform for taxpayers to interact with the Federal Board of Revenue. By logging into this system, taxpayers can fulfill various obligations such as filing income tax returns, registering for sales tax, viewing tax notices, and managing tax-related documents.

The login process is straightforward, but understanding its importance, prerequisites, and features can make it more accessible for all users. Below, we delve into each aspect of the FBR login to provide you with a comprehensive understanding.

Why is FBR Login Important?

Logging into the FBR portal is vital for:

- Filing Tax Returns: Taxpayers must submit their income and sales tax returns online through the IRIS system.

- Taxpayer Profile Management: Individuals and businesses can update their profiles, including contact information, addresses, and financial details.

- Payment of Taxes: Taxes can be paid directly through the portal, linking users to banking systems.

- Ease of Access to Tax Records: Taxpayers can view previous filings, payments, and notices issued by FBR.

- Compliance and Transparency: The portal ensures taxpayers remain compliant with FBR regulations, avoiding penalties and fostering transparency in tax affairs.

Features of FBR Login

Once logged into the IRIS portal, taxpayers gain access to several features:

1. Tax Return Filing

- Individuals and businesses can submit their annual tax returns.

- The system provides templates for income tax and sales tax returns.

2. Tax Registration

- New users can register for National Tax Numbers (NTN) and sales tax numbers.

- Business owners can register their businesses for tax purposes.

3. Tax Payments

- Users can pay taxes directly through the portal.

- Integration with banks enables secure and fast transactions.

4. Access to Notices and Communication

- The portal displays tax notices issued by FBR.

- Taxpayers can respond to queries or comply with directives through the system.

5. Refund Tracking

- Users can check the status of tax refunds.

- The system provides updates on refund approvals or rejections.

6. Document Upload and Management

- Taxpayers can upload documents related to their financial activities.

- Secure storage ensures easy retrieval when needed.

How to Log In to the FBR Portal

Step 1: Access the IRIS Portal

- Open your internet browser.

- Navigate to the FBR website: https://fbr.gov.pk.

- Click on the IRIS Login link or directly visit https://iris.fbr.gov.pk.

Step 2: Enter Your Credentials

- In the login form, enter your username (usually your NTN or CNIC number).

- Enter your password.

- Complete the CAPTCHA verification.

- Click the Login button.

Step 3: Access Your Dashboard

- After logging in, you will be directed to the IRIS dashboard.

- Here, you can navigate various options such as filing returns, viewing notices, and updating your profile.

How to Register for FBR Login

If you are a new user, follow these steps to register:

Step 1: Access the Registration Page

- Go to the IRIS portal and click on the Registration link.

Step 2: Provide Personal Information

- Enter your CNIC number and other required details.

- Provide a valid email address and phone number.

Step 3: Verification

- You will receive an email with an activation link.

- Click the link to verify your account and complete the registration process.

Step 4: Set Up Your Profile

- Log in to your account and update your profile with additional details such as your address, income sources, and business information.

Recovering FBR Login Credentials

If you forget your login details, you can recover them by following these steps:

Step 1: Reset Password

- On the IRIS login page, click Forgot Password.

- Enter your NTN or CNIC number and registered email address.

- Follow the instructions sent to your email to reset your password.

Step 2: Recover Username

- If you cannot remember your username, contact the FBR helpline for assistance.

Common Issues and Solutions

Despite its user-friendly design, users may encounter issues while logging into the FBR portal. Below are common problems and their solutions:

1. Invalid Credentials

- Double-check your username and password.

- Ensure the CAPS LOCK is turned off.

2. Locked Account

- Accounts may get locked after multiple failed login attempts.

- Contact the FBR helpline at 051-111-772-772 to unlock your account.

3. Technical Glitches

- Clear your browser cache or use a different browser.

- Ensure your internet connection is stable.

4. Expired Password

- Change your password regularly to maintain security.

- Use the Forgot Password option if your password has expired.

Tips for Secure Login

- Use a Strong Password:

- Combine uppercase letters, lowercase letters, numbers, and special characters.

- Avoid Sharing Credentials:

- Keep your username and password confidential.

- Enable Two-Factor Authentication (2FA):

- If available, enable 2FA for added security.

- Log Out After Use:

- Always log out after completing your tasks, especially on shared devices.

- Keep Contact Information Updated:

- Ensure your email and phone number are current to receive updates and notifications.

Benefits of Using FBR Login

1. Time-Saving

- Taxpayers can complete all tax-related tasks online without visiting FBR offices.

2. Transparency

- The portal allows users to monitor their tax history, reducing chances of discrepancies.

3. Compliance

- The system helps taxpayers stay compliant with deadlines and regulations.

4. Security

- Secure access ensures the safety of sensitive financial data.

5. Convenience

- Available 24/7, the portal is accessible from anywhere with an internet connection.

Conclusion

The FBR login process, through the IRIS portal, is a significant step toward digitizing Pakistan’s tax system. By offering a seamless platform for tax management, FBR has made it easier for taxpayers to comply with their obligations while fostering transparency and accountability. Whether you are an individual taxpayer or a business owner, mastering the FBR login process ensures you stay on top of your tax responsibilities efficiently and securely.