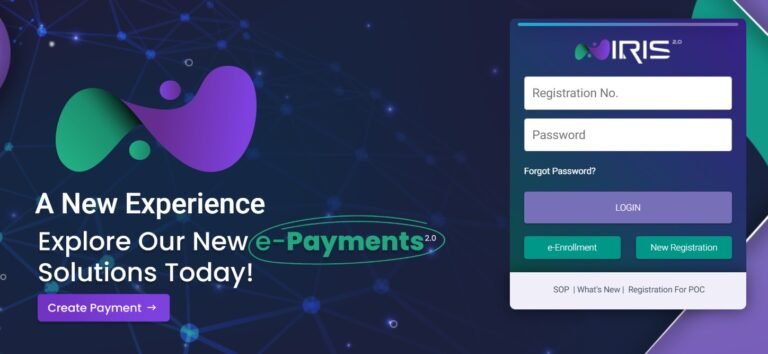

Recently, the Federal Board of Revenue (FBR) introduced a significant change to the login system of its tax filing service, IRIS. According to this new policy, all users’ login passwords will expire every 60 days, requiring them to reset their passwords afterward. While this step aims to enhance security, it has also introduced several challenges, especially for individual taxpayers and tax consultants.

Objectives of the New Policy

The primary goal of this change is to strengthen the security of taxpayers’ accounts, preventing unauthorized access. Given the evolving security standards and digital threats, this measure was deemed necessary. However, the challenges faced by users as a result of this policy cannot be overlooked.

Challenges Faced by Users

This policy has brought multiple challenges for taxpayers and consultants, including:

1. Issues with Password Resets

The process of resetting passwords every 60 days is time-consuming, especially for individuals who manage their tax filings independently. If a user’s registered mobile number or email is inactive, it can lead to significant hurdles.

2. Increased Pressure on Tax Consultants

Tax consultants, who handle tax filings for multiple clients, face a particularly difficult task. Resetting passwords for each client’s account is a tedious and time-intensive process, especially when the number of clients is high.

3. Security Risks

If consultants or users fail to manage login information properly, the risk of data leaks or unauthorized access increases, posing a significant security concern.

4. Additional Costs

Tax consultants may need to increase their service charges to accommodate this additional workload, which could become a financial burden for clients.

Possible Solutions to the Challenges

To address these issues, the following steps can be taken:

1. Keep Client Information Updated

All users, especially tax consultants, should ensure that their clients’ registered mobile numbers and email addresses are up-to-date to facilitate a seamless password reset process.

2. Utilize Automation Tools

Consultants should use digital tools or software to organize client data. This will simplify the password reset process and save time.

3. Request Flexibility from FBR

Taxpayers and consultants can request FBR to extend the password reset period from 60 days to 90 days or more, reducing the frequency of this requirement.

4. Run Awareness Campaigns

FBR should launch public awareness campaigns to educate users about the new policy, ensuring they are well-prepared to comply with it.

Conclusion

While FBR’s new policy is undoubtedly a positive step toward enhancing security, the challenges faced during its implementation need attention. Taxpayers and consultants must prepare themselves to address these challenges proactively, while FBR should consider making the policy more user-friendly. If these steps are taken, the policy will not only strengthen security but also prove convenient for users.

- How to Register in FBR: A Step-by-Step Guide

- ایف بی آر کی بڑی تجویز: اپیلٹ ٹربیونلز سے ان لینڈ ریونیو افسران کی چھٹی؟

- Pakistan Real Estate Tax Reforms 2025: Boosting the Property Sector

- How FBR Leverages Data, AI, and Audits to Analyze the Top 5% Taxpayers for Maximized Revenue and Equity

- Major Crackdown on Tax Evasion: FBR Issues Notices to 190,000 Individuals!