Being a filer in Pakistan comes with several financial benefits, including lower tax deductions on banking transactions, property purchases, and vehicle registration. The Federal Board of Revenue (FBR) allows individuals to check their filer status online using their CNIC (Computerized National Identity Card) number. This guide will walk you through the simple steps to check your FBR filer status online.

Why Check Your Filer Status?

Checking your filer status is essential for:

- Ensuring your name is included in the Active Taxpayer List (ATL).

- Availing reduced withholding tax rates.

- Avoiding penalties for non-filers.

- Confirming your tax compliance before making financial transactions.

Methods to Check FBR Filer Status Online

FBR provides two primary ways to check your filer status online:

- Through the FBR Website

- Via SMS Service

Method 1: Check Filer Status via FBR Website

Follow these steps to check your FBR filer status using the official website:

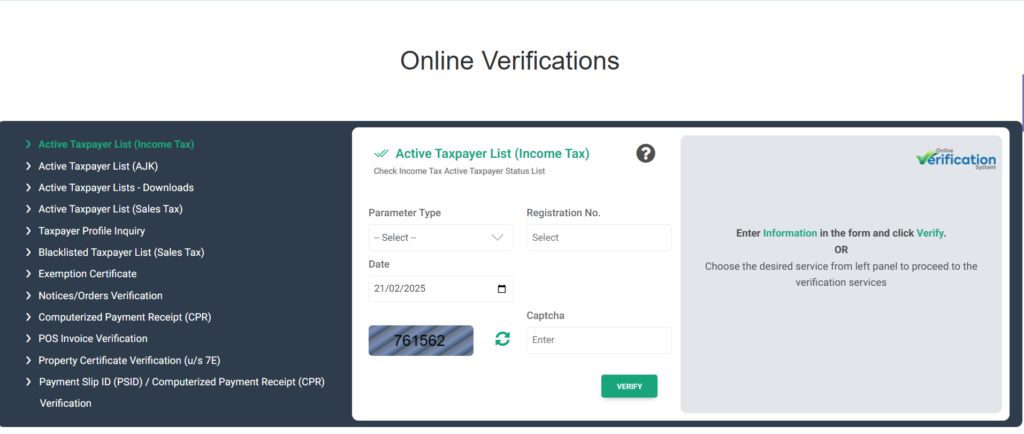

- Visit the FBR Website:

- Go to the Federal Board of Revenue (FBR) official website: https://www.fbr.gov.pk

- Navigate to Active Taxpayer List (ATL):

- Click on the “Active Taxpayer List (ATL)” section.

- Select Income Tax ATL.

- Enter Your CNIC:

- In the search bar, enter your CNIC number (without dashes).

- Click on the search button.

- Check Your Status:

- If your name appears in the Active Taxpayer List (ATL), you are a filer.

- If not, you are a non-filer and need to file your tax returns to be added to the ATL.

Method 2: Check Filer Status via SMS

If you don’t have access to the internet, you can check your filer status via SMS by following these steps:

- Open your SMS application.

- Type ATL (space) CNIC number (without dashes).

- Send it to 9966.

- Receive Confirmation:

- If you are a filer, you will receive a message confirming your active taxpayer status.

- If you are a non-filer, you will be informed that your CNIC is not in the Active Taxpayer List.

How to Become a Filer in Pakistan?

If you are a non-filer and want to become a filer, follow these steps:

- Register for an FBR account on Iris Portal.

- Obtain an NTN (National Tax Number).

- File your income tax return through the FBR Iris system.

- Wait for the next ATL update, as FBR updates the Active Taxpayer List every Monday.

Final Thoughts

Checking your FBR filer status online by CNIC is quick and easy, whether through the FBR website or SMS service. If you are a non-filer, it’s highly recommended to file your tax returns to enjoy lower tax rates and avoid penalties.