Registering with the Federal Board of Revenue (FBR) is crucial for individuals and businesses in Pakistan to comply with tax regulations. If you’re planning to register but don’t know where to start, this guide will walk you through the process.

Step 1: Visit the FBR IRIS Portal

First, navigate to the official FBR IRIS portal using your internet browser. This portal serves as the hub for all tax-related activities, including registration.

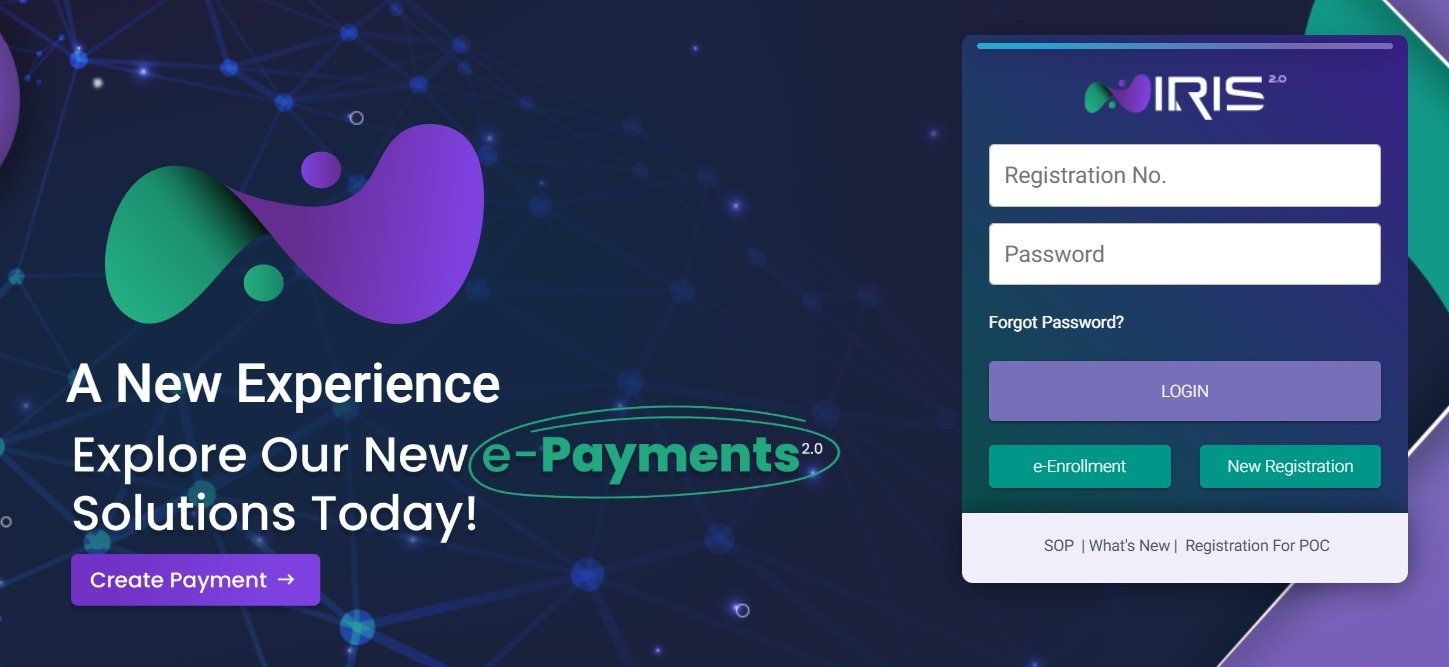

Step 2: Click on “New Registration”

On the IRIS login page, locate the “New Registration” button on the right side of the screen. Click it to proceed to the registration form.

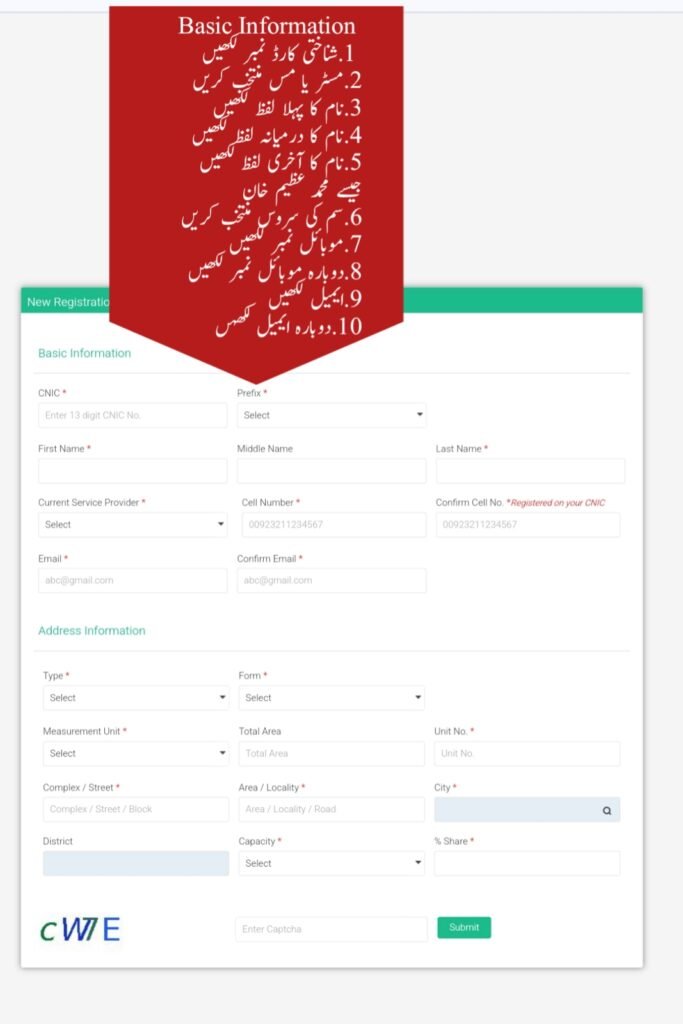

Step 3: Enter Basic Information

Fill out the required fields:

- CNIC (Computerized National Identity Card): Enter your CNIC without dashes.

- Prefix: Choose your title (e.g., Mr., Mrs., Ms., etc.) from the dropdown menu.

- Full Name: Enter your first, middle (if applicable), and last name.

- Cell Number: Ensure the number you provide is registered in your name with your service provider.

- Email Address: Enter a valid email and confirm it. Make sure to use an active email account, as it will be used for communication.

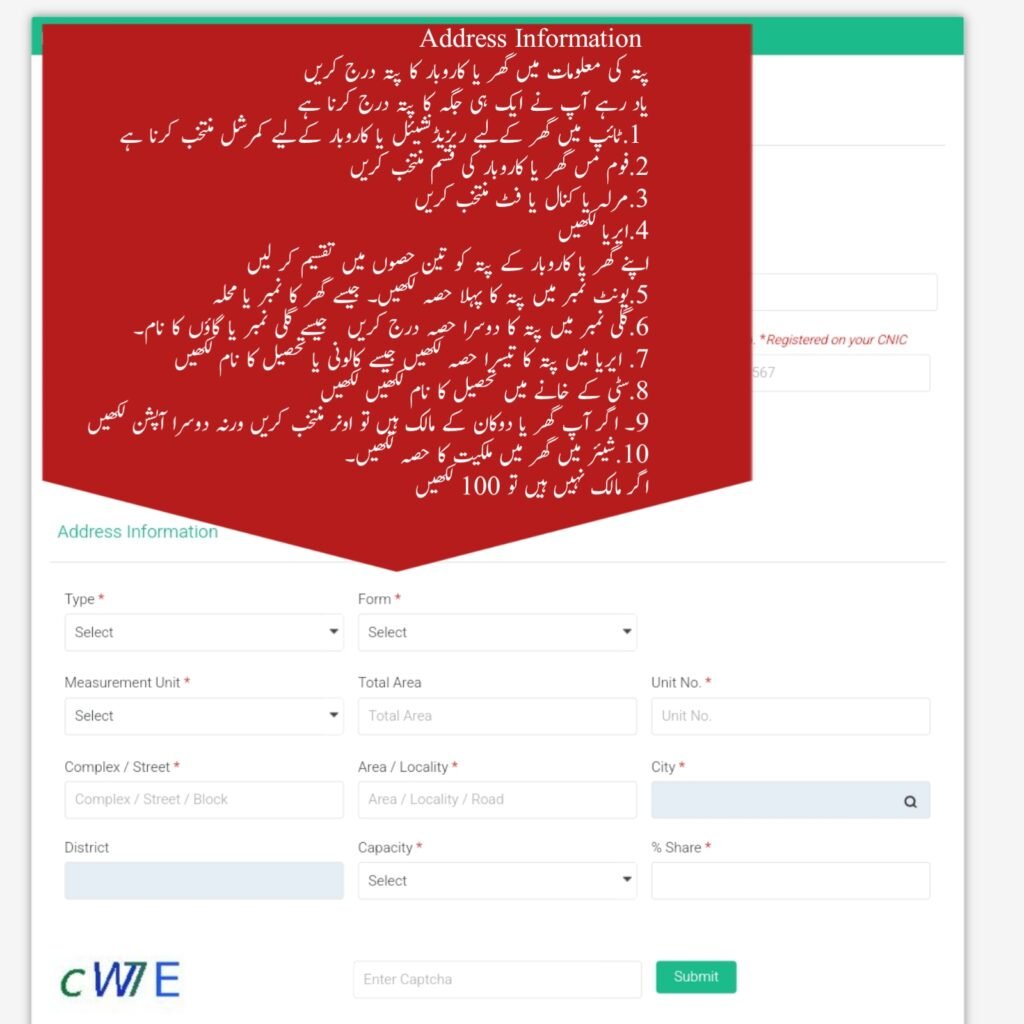

Step 4: Provide Address Information

In the next section, input your address details:

- Type: Select whether the address is residential or commercial.

- Measurement Unit: Specify the measurement unit for your property’s area (e.g., square feet).

- Street/Complex: Provide the name of your street or complex.

- City and District: Use the search option to select your area from the list.

- Capacity and Share Percentage: If registering a business, include details like your ownership capacity and the percentage of shareholding.

Step 5: Complete the Captcha and Submit

Enter the characters shown in the captcha and click “Submit” to complete your registration.

Step 6: Verify Your Information

Once you have submitted your registration, FBR will verify your details. You may receive a verification code on your registered mobile number or email. Use this code to confirm your registration.

Additional Tips for FBR Registration

- Double-check all information before submitting to avoid errors.

- Keep your CNIC, phone number, and email active for any future verification or updates.

- If you encounter any issues, you can seek help through the FBR helpline or visit the nearest FBR office.

Conclusion

Registering with the FBR might seem daunting, but by following these steps, you can complete the process smoothly. Remember, staying compliant with tax laws not only helps in avoiding penalties but also contributes to the country’s economy.

For more details, visit the official FBR website or consult a tax expert.

And For more Learning Keep Visiting FBRIRIS.com