Salary Tax Calculator (2025)

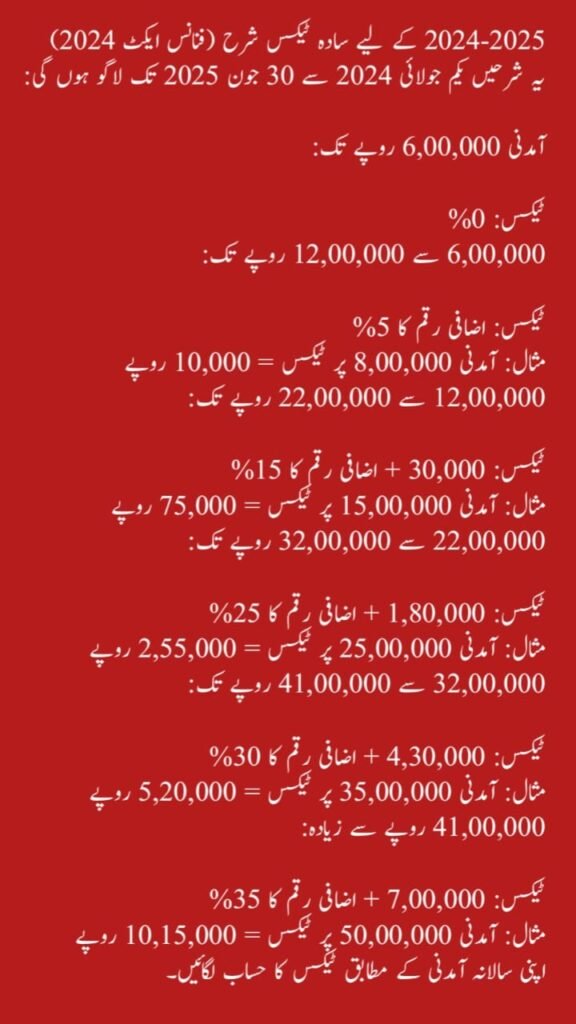

Simplified Tax Rates for 2024-2025 (Finance Act 2024)

These tax rates are applicable for the period July 1, 2024, to June 30, 2025.

1. Income up to Rs. 600,000

- No tax for individuals earning up to Rs. 600,000 annually.

2. Income between Rs. 600,000 and Rs. 1,200,000

- Tax Rate: 5% of the amount exceeding Rs. 600,000

- Example:

- Income: Rs. 800,000

- Taxable Amount: Rs. 800,000 - Rs. 600,000 = Rs. 200,000

- Tax Payable: 5% of Rs. 200,000 = Rs. 10,000

3. Income between Rs. 1,200,000 and Rs. 2,200,000

- Tax Rate: Rs. 30,000 + 15% of the amount exceeding Rs. 1,200,000

- Example:

- Income: Rs. 1,500,000

- Taxable Amount: Rs. 1,500,000 - Rs. 1,200,000 = Rs. 300,000

- Tax Payable: Rs. 30,000 + (15% of Rs. 300,000) = Rs. 75,000

4. Income between Rs. 2,200,000 and Rs. 3,200,000

- Tax Rate: Rs. 180,000 + 25% of the amount exceeding Rs. 2,200,000

- Example:

- Income: Rs. 2,500,000

- Taxable Amount: Rs. 2,500,000 - Rs. 2,200,000 = Rs. 300,000

- Tax Payable: Rs. 180,000 + (25% of Rs. 300,000) = Rs. 255,000

5. Income between Rs. 3,200,000 and Rs. 4,100,000

- Tax Rate: Rs. 430,000 + 30% of the amount exceeding Rs. 3,200,000

- Example:

- Income: Rs. 3,500,000

- Taxable Amount: Rs. 3,500,000 - Rs. 3,200,000 = Rs. 300,000

- Tax Payable: Rs. 430,000 + (30% of Rs. 300,000) = Rs. 520,000

6. Income exceeding Rs. 4,100,000

- Tax Rate: Rs. 700,000 + 35% of the amount exceeding Rs. 4,100,000

- Example:

- Income: Rs. 5,000,000

- Taxable Amount: Rs. 5,000,000 - Rs. 4,100,000 = Rs. 900,000

- Tax Payable: Rs. 700,000 + (35% of Rs. 900,000) = Rs. 1,015,000